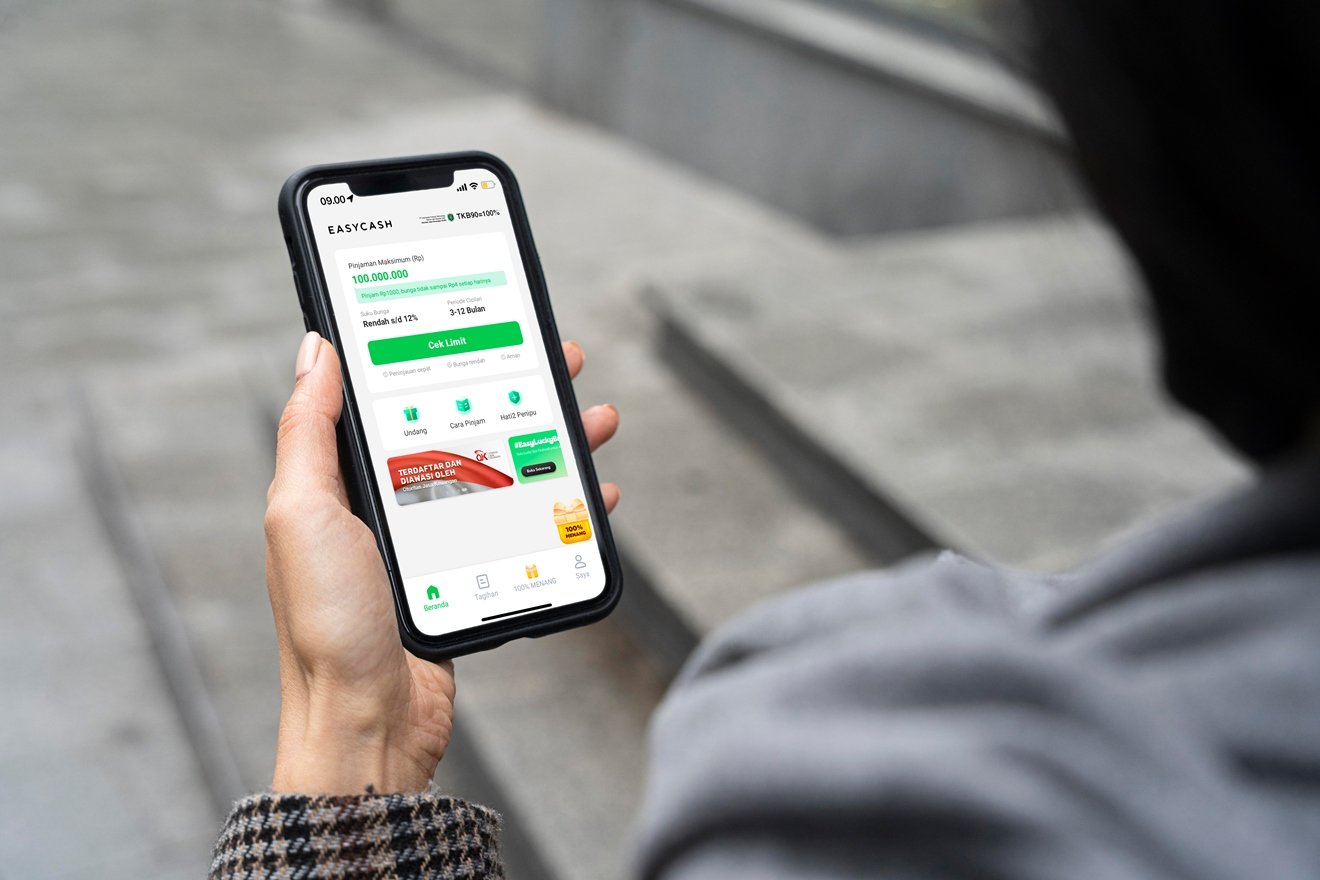

Easycash (PT Indonesia Fintopia Technology) and Bank Jago (PT Bank Jago Tbk) inaugurated a loan channeling collaboration to increase financial inclusion in Indonesia, especially for people who do not have access to banking facilities or financial products. Easycash, as an information technology-based joint funding platform licensed and supervised by the Financial Services Authority (OJK), has a mission to improve access to public financial facilities using technology.

Supporting Financial Inclusion Program, Easycash and Bank Jago Establish Loan Channeling Collaboration

Through this collaboration, Bank Jago is committed to providing loan channeling to Easycash which will be used to increase the distribution of cash loans to its users. “This collaboration between Easycash and Bank Jago can provide innovative solutions and provide access to finance for more users. Then, as a platform in the fintech industry, we hope that we can work together to increase financial inclusion in Indonesia," said Victor Laoh, Director of Easycash.

OJK has announced the results of the 2022 National Financial Literacy and Inclusion Survey (SNLIK) which show an increase in the public financial literacy and inclusion index. One of the 2022 SNLIK results shows a financial inclusion index of 85.10 percent. This value has increased compared to one of the 2019 SNLIK results, namely the financial inclusion index of 76.19 percent.

"Having aspirations to increase opportunities for growth for millions of people through digital financial solutions that focus on life, Bank Jago collaborates with Easycash to provide financing to customers by optimizing technology. We hope that this collaboration will continue so that we can increase opportunities for more Indonesians to grow," said Sonny Joseph, Director of Bank Jago.

Since it was founded in 2017 until now, Easycash has recorded a total accumulated loan of more than IDR 30 trillion and has 11 million registered users. This achievement was recorded while maintaining the success rate of settlement of loan obligations within a period of up to 90 days from the due date (TKB90) of 100% as of August 2, 2023.

"Thank you to Bank Jago for putting a trust and providing loan channeling facilities to Easycash. We will maintain this trust through the use of machine learning technology and the latest risk mitigation parameters," said Victor.

Stallone Tjia

Stallone Tjia

Aug 11, 2023

Aug 11, 2023