The funding distribution of Easycash will increase after obtaining Superbank loan channelling cooperation so that this P2P lending company will serve more underbanked and underserved people

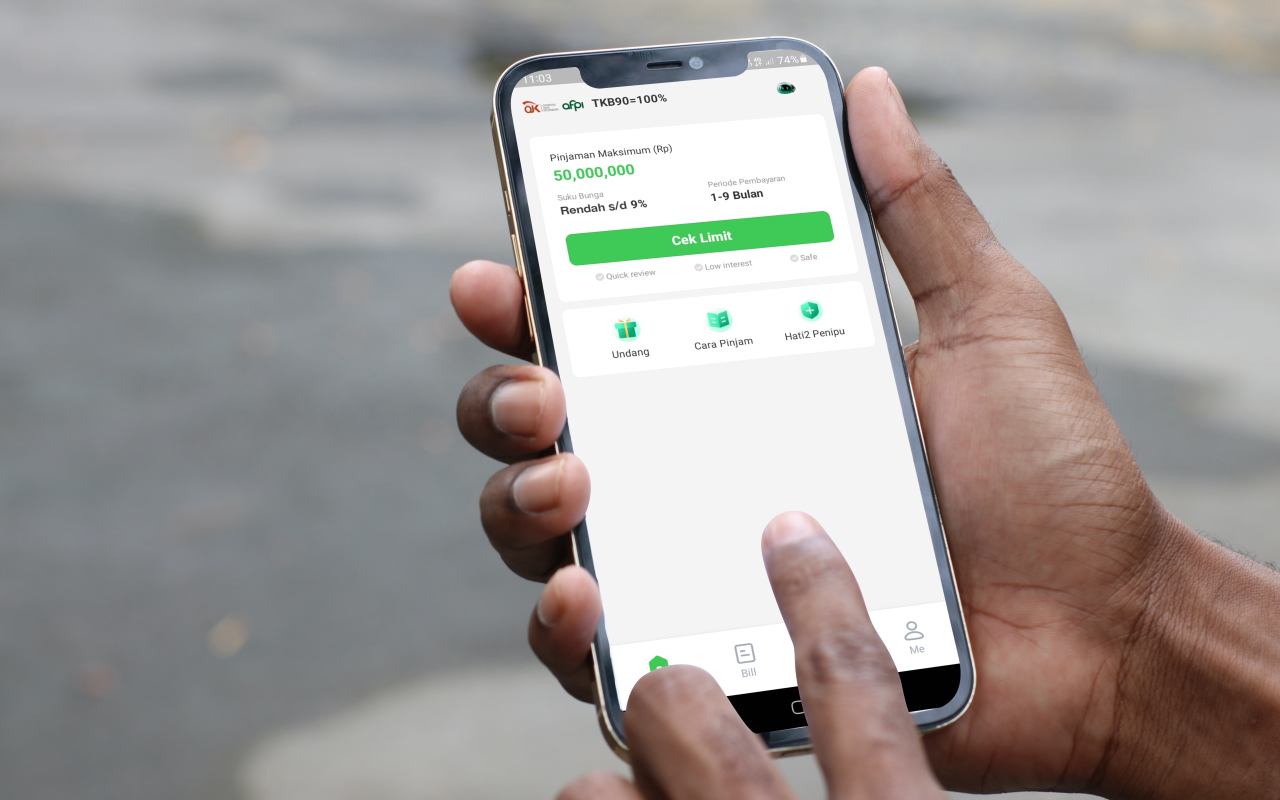

Easycash (PT Indonesia Fintopia Technology) has inaugurated a loan channeling collaboration with Superbank. This symbolic inauguration event took place at the opening of Superbank’s newest branch office located at One Satrio. This program aligns with Easycash’s mission as an Information Technology-Based Joint Funding Service (LPBBTI) to increase community access to financial facilities.

Easycash Establishes Loan Channeling Cooperation with Superbank to Increase Financial Inclusion

Dr. Jonathan Chang, President Director of Easycash, stated, “Since operating in Indonesia, we have been committed to increasing financial inclusion for underbanked and underserved communities using technology. Easycash continues to innovate so that more people can benefit from access to financial facilities. In developing this market share, we believe that Superbank has the same vision as Easycash regarding expanding financial access for the community. “Therefore, I hope this collaboration can start various good collaborations between Superbank and Easycash in the future.”

Sukiwan, Chief Business Officer of Superbank, responded to the collaboration between Easycash and Superbank, “Apart from being known as one of the LPBBTI platforms with the largest distribution of funds in Indonesia, Easycash has been proven to be a transparent platform for Lenders and Recipients of Funds. The transaction process in the app is also fast, easy, and secure.”

Since its establishment in 2017, Easycash has recorded a total accumulated funding distribution of more than IDR 37 trillion and recorded more than 5 million total accumulated recipients of funds. This achievement was recorded while maintaining the success rate in completing loan obligations within a period of up to 90 days from the due date (TKB90) of 100% as of November 30, 2023.

After gaining the trust of the public and other financial sector players, Easycash will continue to innovate and improve services for users. “We will continue to provide fast, safe, and reliable service to lenders and borrowers. Easycash will also continue to collaborate with the government and other stakeholders to advance the financial industry in Indonesia,” concluded Dr. Jonathan Chang.

Stallone Tjia

Stallone Tjia

Dec 28, 2023

Dec 28, 2023