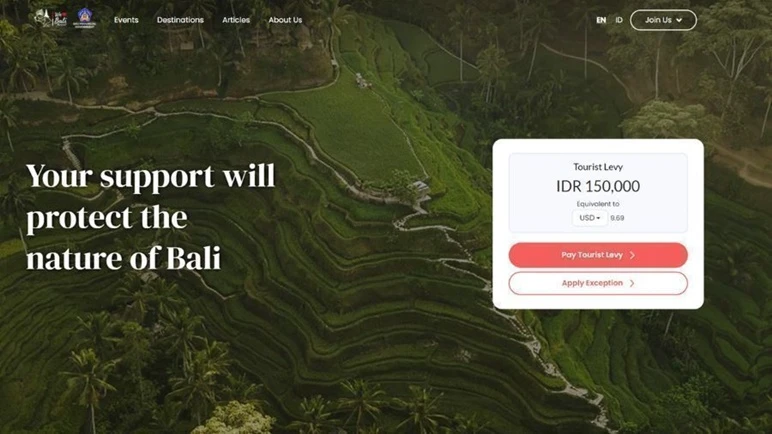

Paying the Bali Tourism Tax is about to get far simpler. What was once a confusing process involving multiple websites and apps is now being reshaped into a streamlined system that integrates directly with immigration and visa applications. But how exactly will this new system work, and what could it mean for the future of travel in Bali? Read on to explore the changes and their wider implications.

The move promises to reduce hassle for visitors while securing much-needed funds for environmental and cultural programs across the island.

Introduced in early 2024, Bali Tourism Tax Levy was meant to be a simple, eco-focused contribution from international visitors. The levy of IDR 150,000 per person supports cultural preservation and environmental protection, particularly river restoration projects. Yet, what began as a straightforward idea quickly became entangled in a complicated web of online platforms and pre-arrival procedures. Tourists found themselves navigating multiple websites and applications before even setting foot on the island, creating friction in what should be a seamless arrival experience.

Integration Into Immigration

The provincial government has now taken a decisive step to simplify the process. The proposed new system integrates the Bali Tourism Tax Levy into the national immigration and visa application process. This means that when travelers apply for their visa, the tax payment will be collected automatically, eliminating the need for separate logins across multiple websites and apps. By folding the levy into immigration, Bali aligns with global best practices in travel facilitation and reduces the risk of missed payments.

The move reflects a broader effort to modernize and centralize systems. It not only creates efficiency for travelers but also provides the government with a more reliable stream of revenue. With the majority of international visitors already using digital platforms for visas, the integration feels like a natural extension rather than an additional burden.

Boosting Compliance Rates

In its first year, the levy revealed a concerning problem. Despite being a mandatory fee, less than 35 percent of tourists paid. That gap between policy and compliance left the government with significantly less funding than forecasted. With millions of annual visitors, the difference between 35 percent compliance and full compliance represents hundreds of billions of rupiah that could be reinvested into cultural heritage and environmental sustainability.

Local Businesses as Payment Points

Alongside the immigration integration, work is underway to create more payment points within Bali. Local travel agencies are being positioned as on-the-ground outlets where tourists can make payments if they missed the online process. These businesses will serve as both facilitators and advocates, reinforcing the importance of the levy. The added incentive of a small commission ensures that agencies have a stake in encouraging compliance.

This dual system of automatic online collection and in-destination payment points could strike the right balance between convenience and accountability. It also represents a smart collaboration between government and private sector, giving local businesses a direct role in supporting Bali’s sustainability agenda.

What the Future Holds

The changes are more than administrative tweaks; they hint at a shift in how Bali manages its tourism economy. Easier payment channels strengthen the island’s position as a world-class destination that takes both visitor experience and environmental responsibility seriously. Yet, questions remain. Will the integration truly solve the compliance problem, or will loopholes still exist?

Tourism is the backbone of Bali’s economy, and with it comes the responsibility to protect the island’s fragile cultural and natural environment. Simplifying the tax payment system is a pragmatic step that reduces barriers for visitors while increasing accountability for the government. For tourists, it means one less headache at arrival. For Bali, it could mean the difference between underfunded promises and a robust, sustainable future.

Billy Bagus

Billy Bagus

Sep 25, 2025

Sep 25, 2025